DTA and contributions to foreign trade: what your finance department should know

Trade openness and nearshoring in North America have boosted Mexican imports, making it essential to correctly manage hidden costs in each operation. El Customs Processing Law (DTA) and other tariff contributions (import VAT, IGI, ISAN, IEPS, etc.) apply when filing the customs order. Not considering these charges may inflate the final cost of the product.

This article contextualizes each charge, analyzes its financial impact and provides practical recommendations. We will look at typical rates and their legal bases, as well as an example of calculating costs for an import of auto parts. In the end, your finance team will be ready to incorporate these burdens into their planning and decisions.

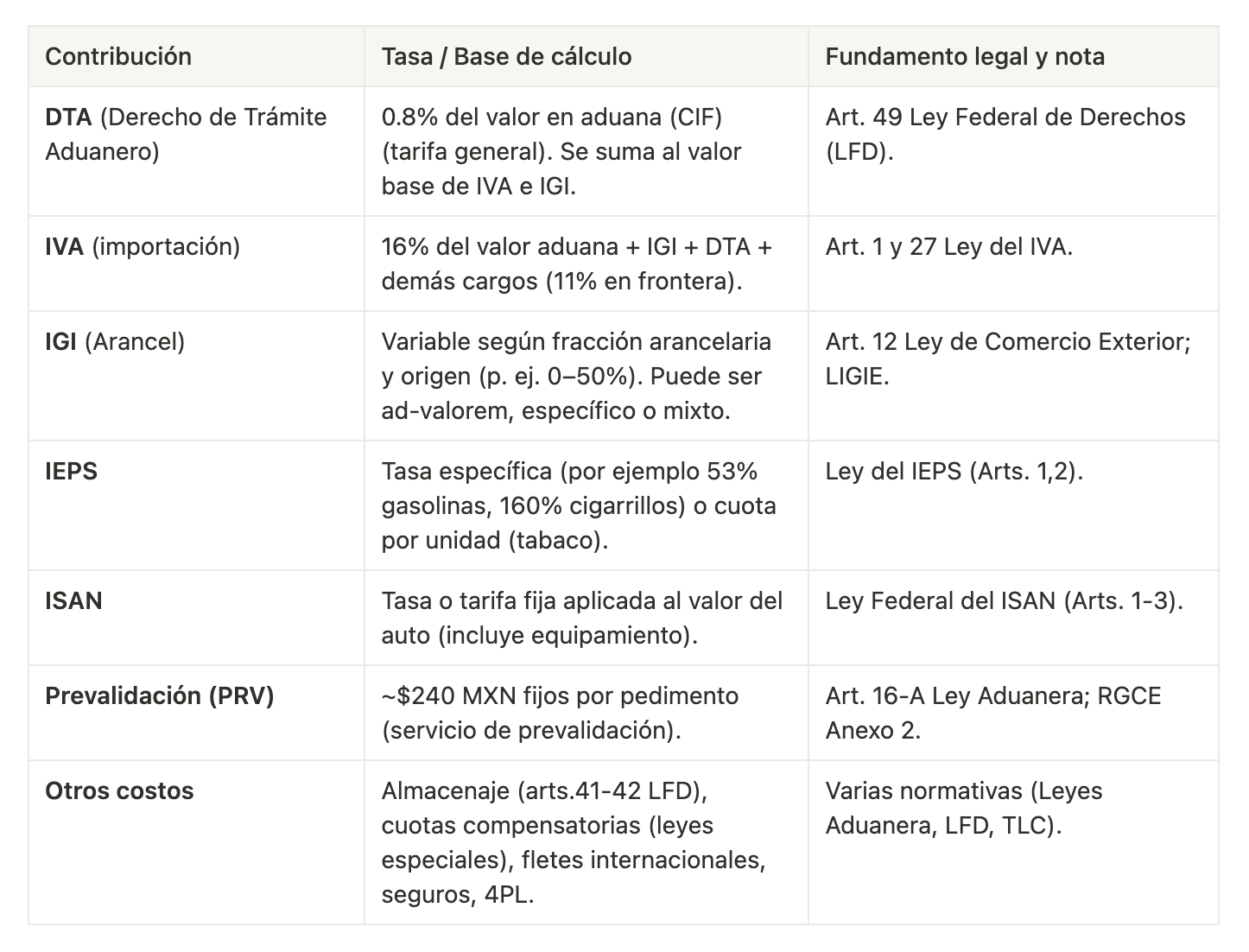

The contributions that may be caused due to importation are the following: General Import Tax (IGI), Value Added Tax (VAT), New Car Tax (ISAN), Special Tax on Production and Services (IEPS), Customs Processing Right (DTA) and Storage Right.

What is the Customs Processing Law (DTA)?

The DTA is a mandatory federal fee for each foreign trade operation When submitting the petition. It applies to all goods entering or leaving the country, even under special regimes. It is regulated by the Federal Bill of Rights. The law establishes a general rate of 8‰ of the customs value of the merchandise (0.8%) (aaag.org.mx). In other words, if the customs value of a shipment is $1,000,000 MXN, the DTA would be $8,000 MXN. There are exceptions: for example, temporary imports of fixed assets for maquiloras pay only 1.76‰, and there are fixed quotas for certain regimes (see Art. 49 LFD). These rates are updated regularly.

It is key to remember that the DTA It is calculated based on the customs value (CIF) Before taxes. In practice, it is added to the amount on which the IGI and VAT are calculated. For this reason, many companies end up paying for it even on their own DTA (cumulative basis).

Recommendations:

- Confirm the calculation base in your ERP or quote to avoid surprises: it must include invoice value + insurance + freight (CIF).

- Consider the DTA when budgeting. Ask the customs agent or forwarder if fixed rates apply (Free Trade Agreements allow exemptions or reduced quotas in certain cases).

- Keep rates up to date: the law updates them biannually.

{{4pl}}

Other import contributions

In addition to the DTA, each order can generate several taxes and duties that affect the total cost:

General Import Tax (IGI)

It's the tariff. The rate depends on the tariff fraction (product) and the origin of the good (Treaty or common rule). It can be Ad Valorem, specific or mixed (barradecommercio.org). For example, auto parts may have an IGI of 5%. Under the T-MEC/NAFTA, many basic inputs pay 0%. Foundation: Art. 12 Foreign Trade Act and LIGIE.

Import VAT

Overall 16% of the CIF value of the import More IGI, DTA and other contributions. In the border area, 11% applies. Note: for certain goods (medical equipment, agriculture) there may be a 0% rate (Annex 27 RGCE). Foundation: Art. 27 VAT Act.

IEPS (Special Tax)

It only applies to specific goods: fuel, tobacco, alcohol, soft drinks, energy drinks, etc. The rates are variable (for example, 53% for strong beers, 160% for tobacco). It is calculated based on the customs value plus IGI, etc. (same as VAT). Foundation: IEPS Act (Arts. 1,2).

ISAN (New Cars)

You only pay when importing new cars. A fixed rate or percentage applies depending on the value which includes optional equipment, without deductions. Foundation: ISAN Act (Arts. 1-3).

PRV (Order Prevalidation)

This is a fixed charge to electronically validate the order before dispatch. For 2023 it was ~$240 MXN per order (lofac.com.mx) (plus $42 VAT, total ~$302). Foundation: Art. 16-A Customs Act and RGCE Rules 1.8.3

Others...

Right of storage (if the merchandise stays long > days off), countervailing fees (anti-dumping), anti-dumping duties, etc. They can also be generated Fines for errors.

Practical example: estimating costs in an import

Let's imagine that a Mexican factory imports auto parts through a forwarder. The shipment is RoRo (vehicles) with an FOB cost of $50,000 USD. International shipping is $5,000 USD and insurance $500 USD. The exchange rate is 20 MXN/USD. Let's assume an IGI of 5% (auto parts rate) and that IEPS or ISAN does not apply.

- Calculate the customs value (CIF) — Invoice value + insurance + freight = $50,000 + $5,000 + $500 = $55,500 USD.

In pesos: $55,500 × 20 = $1,110,000 MXN. - DATA (0.8%) — 0.008 × $1,110,000 = $8,880 MXN.

- GIGI (5%) — 0.05 × $1,110,000 = $55,500 MXN.

- VAT (16%) — Applies to the sum CIF + IGI + DATA:

Base = $1,110,000 + $8,880 + $55,500 = $1,174,380 MXN.

VAT = 0.16 × $1,174,380 = $187,901 MXN. - Total contributions:

- DATE: $8,880 MXN

- GIGI: $55,500 MXN

- VAT: $187,901 MXN

Total customs taxes: ~$252,281 MXN.

- Approximate total cost: —- $1,174,380 (CIF + IGI + DATE) + $187,901 (VAT) = $1,362,281 MXN.

In this example, contributions increased the cost of the order by ~ 23% over the base CIF value. In addition, it is necessary to add internal freight, handling, 4PL, port fees, etc. to obtain the final logistics cost. Note that the RoRo or LoLo modality does not alter these rates: they always apply to the customs value.

Practical recommendations

- When requesting quotes (to carriers, forwarders or 4PL), ask for a breakdown: value of the merchandise, DTA, IGI and VAT separately. This way you avoid surprises in the final budget.

- If your import includes project loads (heavy machinery, special containers or RoRo), reviews possible special regimes; e.g. IMMEX machinery with reduced DTA 1.76‰ (aaag.org.mx) or valuation facilities.

- Adjust your financial schedule: schedule IGI/DTA payment dates before dispatch to avoid fines. Be liquid on the order date.

- Constantly scan your import CFDI: confirm that the amounts paid match the values of your order. An internal audit can correct tariff classification errors that inflate taxes.

Impact on finance and best practices

Customs contributions directly impact profitability and cash flow. As the acquisition cost increases, they make the sales price more expensive and reduce margins. In addition, undocumented or underpaid expenses may lose tax deductibility. It's crucial that finance and logistics work hand in hand: both must know the rules and anticipate these costs.

Ignorance of customs taxes can lead to unexpected financial closures. A good practice is to integrate DTA, VAT and IGI estimates into the budget and coordinate with your customs broker.

Analysis

- Each contribution (VAT, IGI, DTA...) implies a real expense to the SAT, which requires timely funding. It impacts cash flow planning.

- Changes in taxes (due to changes in tariff or classification) can alter the profitability of an imported product.

- In the case of Nearshoring and increasing imports from North America, companies must be even more agile: growing inventories and purchases demand fiscal precision.

Recommended Best Practices

- Request full quotes: Demand your forwarder/4PL a breakdown of all components (product + DTA + IGI + VAT + freight + insurance). This facilitates comparisons and avoids risks of concealment.

- Align teams: Finance and foreign trade must reconcile the tariff classification of each product. A change in the fraction can mean a jump in taxes. Perform periodic audits of orders.

- Plan ahead: Include key tax payment dates in your annual budget (for example, at the close of each office). Consider interest for extemporaneous payments.

- Automate calculations: Evaluate ERP tools or solutions that integrate a customs cost calculator based on your contracts and tariffs. This way your finance department will have real data before authorizing an import.

- Ongoing training: Stay aware of regulatory changes (new quotas, TLCs, RGCE rules) that affect your contributions. The Ministry of Finance publishes biannual updates to the DTA and RGCE annexes.

{{asesoria}}

In short, a solid financial strategy for foreign trade requires considering every customs contribution from quotation to final payment. The DTA, although small in percentage, links the calculation of other taxes (VAT and IGI). Our recommendation: Don't let hidden costs take your company by surprise. With a clear plan, support from 4PL/Forwarder experts and prior estimates, you'll ensure that your finance department keeps the total cost of importing under control.

Source: Official information from the SAT and specialized literature on foreign trade (adapted to March 2025). Each operation may vary depending on its nature, so always consult your customs advisor.

Everything your logistics needs